Revolutionize Your Finances With Gomyfinance.com Create Budget

Ever felt like your money is slipping through your fingers faster than you can grab it? Well, it’s time to take control, and gomyfinance.com create budget is here to help you do just that. Picture this: a platform that not only helps you track your spending but also empowers you to build a budget that actually works for your life. Sound too good to be true? It’s not—keep reading, and let’s dive into how gomyfinance.com can transform your financial game.

Managing finances isn’t just about crunching numbers; it’s about creating a system that aligns with your lifestyle and goals. That’s where gomyfinance.com comes into play. This isn’t just another budgeting app; it’s a personal finance assistant that adapts to your needs, helping you create a budget that’s realistic and sustainable.

So why should you care? Because taking control of your money isn’t just about saving—it’s about investing in your future. Whether you’re looking to pay off debt, save for a dream vacation, or simply understand where your money’s going, gomyfinance.com create budget has got your back. Let’s explore why this platform is the game-changer you’ve been waiting for.

- Kenny Smith Allstar The Journey Achievements And Legacy

- Alice Rosenblum Porn Leaks The Untold Story You Need To Know

Table of Contents

- Introduction to Gomyfinance.com

- How Gomyfinance.com Create Budget Works

- Benefits of Using Gomyfinance.com

- Key Features of Gomyfinance.com

- Expert Budgeting Tips with Gomyfinance.com

- Comparison with Other Budgeting Tools

- Security and Privacy on Gomyfinance.com

- Data Insights from Gomyfinance.com

- User Experience and Reviews

- Frequently Asked Questions

Introduction to Gomyfinance.com

Let’s talk about gomyfinance.com for a sec. This platform is more than just a website or an app—it’s a financial lifeline for anyone who wants to get serious about their money. Whether you’re a first-timer in the world of budgeting or a seasoned pro looking for a better tool, gomyfinance.com create budget offers something for everyone.

What sets it apart? For starters, it’s user-friendly as heck. No need to be a finance wizard to navigate the platform. Plus, it integrates seamlessly with your bank accounts, credit cards, and other financial tools, giving you a complete picture of your financial health.

Why Choose Gomyfinance.com?

There are tons of budgeting tools out there, but gomyfinance.com stands out because of its personalized approach. It doesn’t just throw generic advice at you; it analyzes your spending patterns and creates a budget tailored to your unique situation. That’s what makes it so effective.

- Goggins Actor The Rise Of A Fitness Icon In Hollywood

- Dwayne Johnson Biography Movie The Rocks Journey From Wrestling To Hollywood Stardom

How Gomyfinance.com Create Budget Works

Alright, so how does gomyfinance.com create budget actually work? Let’s break it down. First, you connect your financial accounts to the platform. Don’t worry—it’s super secure, and we’ll dive into that later. Once connected, gomyfinance.com starts pulling in all your transaction data.

Then, the magic happens. The platform categorizes your spending into different buckets, like groceries, entertainment, and bills. From there, it suggests a budget based on your historical spending habits and financial goals. But here’s the kicker—you have full control. You can adjust the categories, set limits, and even add custom categories to fit your lifestyle.

Step-by-Step Guide

- Sign up for a free account on gomyfinance.com.

- Connect your bank accounts and credit cards.

- Let the platform analyze your spending habits.

- Create or adjust your budget based on the suggestions.

- Track your progress and make adjustments as needed.

Benefits of Using Gomyfinance.com

Now that we’ve covered the basics, let’s talk about why gomyfinance.com create budget is worth your time. Here are some of the top benefits:

Saves You Time

Let’s face it—managing finances can be time-consuming. But with gomyfinance.com, everything is automated. No more manually tracking receipts or entering transactions. The platform does all the heavy lifting for you.

Helps You Stay Organized

Gone are the days of scattered spreadsheets and forgotten expenses. Gomyfinance.com keeps everything in one place, so you always know where you stand financially.

Encourages Financial Discipline

When you see your spending laid out in front of you, it’s easier to identify areas where you can cut back. Gomyfinance.com create budget helps you stay disciplined by holding you accountable to your financial goals.

Key Features of Gomyfinance.com

What makes gomyfinance.com create budget so powerful? Here are some of its standout features:

Automatic Transaction Categorization

The platform automatically sorts your transactions into categories, saving you time and effort. Plus, it learns over time, so the more you use it, the better it gets at categorizing your spending.

Customizable Budgets

Not everyone’s financial situation is the same, which is why gomyfinance.com allows you to customize your budget. You can set limits for each category, add new categories, and even create subcategories for more detailed tracking.

Goal Setting

Whether you’re saving for a down payment on a house or trying to pay off student loans, gomyfinance.com helps you set and achieve your financial goals. It breaks down your goals into manageable steps and tracks your progress along the way.

Expert Budgeting Tips with Gomyfinance.com

Ready to level up your budgeting game? Here are some expert tips to get the most out of gomyfinance.com create budget:

Start Small

Don’t try to overhaul your entire financial life overnight. Start by setting a few small, achievable goals. Once you’ve got those down, you can gradually add more complexity to your budget.

Review Your Budget Regularly

Life changes, and so should your budget. Make it a habit to review your budget at least once a month to ensure it’s still aligned with your goals and circumstances.

Use the Insights Feature

Gomyfinance.com offers valuable insights into your spending habits. Use these insights to identify areas where you can improve and make data-driven decisions about your finances.

Comparison with Other Budgeting Tools

How does gomyfinance.com stack up against other budgeting tools? Let’s take a look:

Against Mint

While Mint is a popular choice, it lacks some of the customization options that gomyfinance.com offers. Plus, gomyfinance.com’s interface is cleaner and more intuitive.

Against YNAB

YNAB (You Need A Budget) is another strong contender, but it can be overwhelming for beginners. Gomyfinance.com strikes a balance between simplicity and functionality, making it accessible to users of all levels.

Security and Privacy on Gomyfinance.com

Security is a top priority for gomyfinance.com. The platform uses bank-level encryption to protect your data and employs strict privacy policies to ensure your information stays safe.

Two-Factor Authentication

Gomyfinance.com offers two-factor authentication for an extra layer of security. This means even if someone gets hold of your password, they won’t be able to access your account without the second form of verification.

Data Insights from Gomyfinance.com

Data is king in the world of finance, and gomyfinance.com knows it. The platform provides detailed insights into your spending habits, helping you make informed decisions about your money.

Spending Trends

See how your spending changes over time and identify patterns that might be holding you back from reaching your financial goals.

Comparison Tools

Compare your spending to others in your demographic to see how you stack up. This can be a great motivator to improve your financial habits.

User Experience and Reviews

What do real users have to say about gomyfinance.com create budget? The reviews are overwhelmingly positive. Users love the platform’s ease of use, customization options, and helpful features.

Common Praise

Many users praise gomyfinance.com for its ability to simplify complex financial data and make budgeting feel less like a chore and more like a game. The platform’s intuitive design and helpful tips make it a favorite among both beginners and experienced budgeters.

Frequently Asked Questions

Still have questions? Here are some common ones we get about gomyfinance.com create budget:

Is Gomyfinance.com Free?

Yes, gomyfinance.com offers a free version with plenty of features to get you started. There’s also a premium version with additional tools and insights for those who want even more functionality.

Can I Use Gomyfinance.com on My Phone?

Absolutely! Gomyfinance.com has a mobile app that lets you manage your finances on the go. Whether you’re at home or out and about, you can stay on top of your budget.

What Happens if I Overspend in a Category?

Gomyfinance.com will alert you if you’re close to or have exceeded your budget in a particular category. It’s like having a financial coach in your pocket, keeping you on track.

Conclusion

There you have it—everything you need to know about gomyfinance.com create budget. Whether you’re looking to save more, spend less, or just get a better handle on your finances, this platform has got you covered. So why wait? Head over to gomyfinance.com and start building the budget that works for you.

Don’t forget to share your thoughts in the comments below. Have you tried gomyfinance.com? What’s your favorite feature? And if you haven’t tried it yet, what’s holding you back? Let’s keep the conversation going and help each other take control of our finances.

- Is Shaq Married The Untold Story Behind The Big Diesels Love Life

- How Much Is Jonathan Majors Worth Unpacking The Stars Rising Net Worth

Weekly Budget Planner Template, Weekly Budget Sheets, Weekly Bill

Budget Visuals FREE Infographic Maker

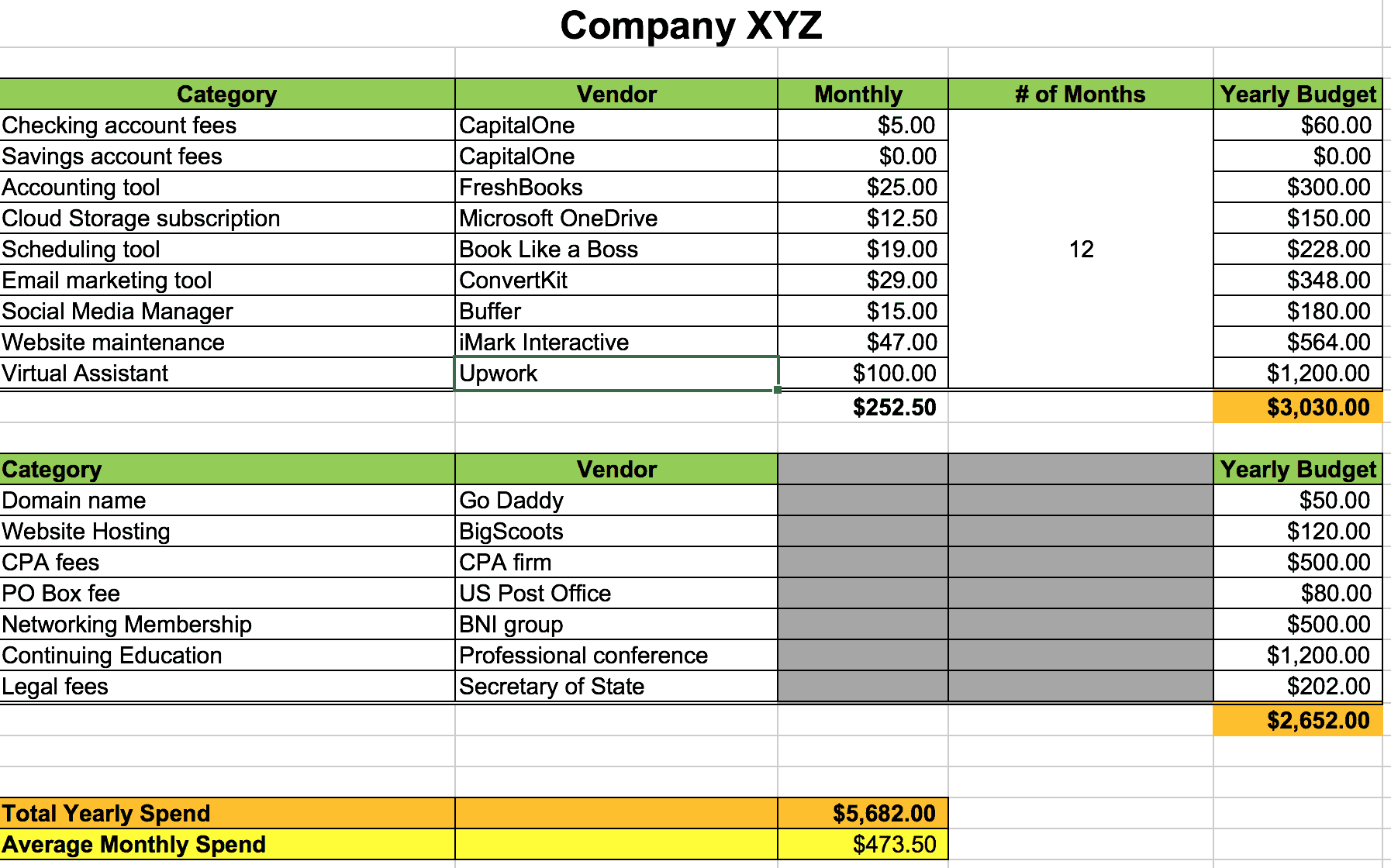

How to Create a Business Budget SMI Financial Coaching