Unveiling The Power Of Roth Net: Your Ultimate Guide

Picture this: you're cruising through the financial world, trying to figure out how to make your money work smarter, not harder. Enter Roth Net—a game-changing concept that could revolutionize your financial strategy. Whether you're a seasoned investor or just starting out, understanding Roth Net can be a game-changer for your financial future. So, buckle up, because we're about to deep-dive into everything you need to know.

Now, let's get real. The financial world can feel like a labyrinth sometimes, with terms and jargon that make your head spin. But don't sweat it. Roth Net is here to simplify things for you. It's like having a financial compass that points you in the right direction. In this guide, we'll break it down step by step, so you can navigate the complexities of Roth Net with confidence.

Before we dive into the nitty-gritty, let's talk about why Roth Net matters. Imagine having a financial tool that not only helps you save but also grows your wealth over time, all while minimizing taxes. Sounds too good to be true, right? Well, that's the magic of Roth Net. So, whether you're aiming to retire early or just want to secure your financial future, this is a concept you need to know.

- Did Dwayne Johnson Die Debunking The Rumors And Celebrating The Rock

- Kenny Smith Allstar The Journey Achievements And Legacy

What Exactly is Roth Net?

Alright, so you've heard the buzzword, but what exactly is Roth Net? Simply put, Roth Net refers to the network of financial strategies and tools centered around Roth accounts. These accounts, particularly Roth IRAs, are designed to help individuals save for retirement in a tax-efficient manner. The beauty of Roth Net lies in its ability to grow your money tax-free, meaning you won't have to pay taxes on your withdrawals during retirement. How cool is that?

Let's break it down a bit further. Traditional retirement accounts, like 401(k)s, allow you to contribute pre-tax dollars, which reduces your taxable income for the year. However, when you withdraw the money in retirement, it's taxed as income. Roth accounts, on the other hand, are funded with after-tax dollars, so your contributions have already been taxed. This means that when you withdraw the money in retirement, it's all yours, tax-free.

Why Should You Care About Roth Net?

Here's the deal: Roth Net isn't just for the financial wizards out there. It's for anyone who wants to take control of their financial future. With the cost of living rising and the uncertainty of future tax rates, having a Roth account in your arsenal can provide peace of mind. Plus, the earlier you start, the more time your money has to grow, thanks to the power of compound interest.

- Is Shaq Married The Untold Story Behind The Big Diesels Love Life

- Virginia Madsen Net Worth A Deep Dive Into The Wealth Of This Talented Actress

Think of Roth Net as your personal financial coach. It helps you make smart decisions about where to put your money, ensuring that it works hard for you. Whether you're saving for a dream vacation, planning for your kids' education, or simply building a safety net, Roth Net can be a valuable asset in your financial toolkit.

Understanding the Basics of Roth IRAs

Now that we've got the big picture, let's zoom in on the foundation of Roth Net: Roth IRAs. An IRA, or Individual Retirement Account, is a type of savings account designed specifically for retirement. The Roth IRA, in particular, is a type of IRA that offers tax-free withdrawals in retirement. This makes it a popular choice for those looking to maximize their retirement savings.

Here are some key features of Roth IRAs:

- Tax-Free Withdrawals: As mentioned earlier, the biggest advantage of a Roth IRA is that your withdrawals in retirement are tax-free.

- Flexibility: Unlike traditional IRAs, Roth IRAs don't require you to start taking distributions at age 72. You can let your money grow as long as you want.

- Income Limits: There are income limits for contributing to a Roth IRA, but there are ways to get around this through a "backdoor" Roth IRA.

- Early Withdrawal Options: While it's generally not recommended, you can withdraw your contributions (not earnings) from a Roth IRA at any time without penalty.

How Does a Roth IRA Fit into Roth Net?

Roth IRAs are the backbone of Roth Net. They provide the framework for building a tax-efficient retirement strategy. By incorporating Roth IRAs into your financial plan, you can create a diversified portfolio that maximizes your savings potential. Whether you're just starting out or looking to enhance your existing retirement plan, Roth IRAs offer a flexible and powerful tool.

Imagine this: you're contributing to a 401(k) at work, but you also want to have a tax-free option for retirement. Enter the Roth IRA. By combining the two, you can create a balanced approach to retirement savings that covers all your bases. It's like having a financial safety net that's tailored to your needs.

Exploring the Benefits of Roth Net

Let's talk benefits. Why should you consider incorporating Roth Net into your financial strategy? The advantages are numerous, and they go beyond just tax savings. Here are some of the key benefits:

- Long-Term Growth: With tax-free withdrawals, your money can grow exponentially over time without the drag of taxes.

- Flexibility: Roth accounts offer more flexibility than traditional retirement accounts, allowing you to access your contributions without penalty.

- Protection Against Tax Rate Changes: With the uncertainty of future tax rates, having a Roth account can provide a hedge against potential increases.

- Estate Planning: Roth accounts can be passed on to heirs tax-free, making them a valuable tool for estate planning.

Think about it this way: you're not just saving for retirement; you're building a legacy. Roth Net allows you to create a financial plan that not only benefits you but also future generations. It's like planting a tree that will provide shade for years to come.

Real-World Examples of Roth Net in Action

Let's bring it home with some real-world examples. Meet Sarah, a 30-year-old marketing specialist who started contributing to a Roth IRA five years ago. By the time she retires at 65, her account has grown to over $500,000, all of which is tax-free. Now, compare that to her colleague, John, who only contributed to a traditional 401(k). While his account balance is similar, he'll have to pay taxes on every dollar he withdraws in retirement.

Then there's Mark, a 50-year-old entrepreneur who used a backdoor Roth IRA to contribute despite exceeding the income limits. By converting his traditional IRA to a Roth IRA, he ensured that his retirement savings would be tax-free when he needed them most. These stories illustrate the power of Roth Net and how it can transform your financial future.

Common Misconceptions About Roth Net

Like any financial concept, Roth Net comes with its fair share of misconceptions. Let's bust some of those myths:

- Myth 1: Roth IRAs are only for young people. Truth is, anyone can benefit from a Roth IRA, regardless of age.

- Myth 2: You can't contribute to a Roth IRA if you have a 401(k). Actually, you can contribute to both, as long as you meet the income limits.

- Myth 3: Roth IRAs are complicated. While there are rules to follow, setting up and managing a Roth IRA is relatively straightforward.

Understanding these misconceptions can help you make informed decisions about incorporating Roth Net into your financial plan. Don't let myths hold you back from taking advantage of this powerful tool.

How to Navigate the Rules of Roth Net

Now that we've cleared up some misconceptions, let's talk about the rules. While Roth Net offers incredible benefits, it's important to follow the guidelines to ensure your contributions are valid. Here are some key rules to keep in mind:

- Contribution Limits: As of 2023, the maximum contribution to a Roth IRA is $6,500 per year, with an additional $1,000 catch-up contribution for those aged 50 and over.

- Income Limits: There are income limits for contributing to a Roth IRA, but you can still participate through a backdoor Roth IRA.

- Withdrawal Rules: To avoid penalties, you must be at least 59½ years old and have had the account for at least five years to withdraw earnings tax-free.

By staying informed about the rules, you can make the most of Roth Net and avoid any potential pitfalls. It's like having a financial roadmap that guides you to your destination.

Building Your Roth Net Strategy

Now that you understand the basics and benefits of Roth Net, it's time to start building your strategy. Here are some steps to get you started:

- Assess Your Financial Goals: Determine what you want to achieve with your Roth Net strategy. Are you saving for retirement, education, or something else?

- Evaluate Your Current Financial Situation: Take stock of your income, expenses, and existing retirement accounts to see how a Roth IRA fits into the picture.

- Choose the Right Account: Decide whether a traditional Roth IRA or a backdoor Roth IRA is the best option for you based on your income and financial goals.

Building a Roth Net strategy is like assembling a puzzle. Each piece fits together to create a complete picture of your financial future. By taking the time to plan and implement your strategy, you can ensure that your money is working as hard as possible for you.

Maximizing Your Roth Net Potential

Once you've established your Roth Net strategy, it's time to maximize its potential. Here are some tips to help you get the most out of your Roth Net:

- Start Early: The earlier you start contributing to a Roth IRA, the more time your money has to grow through compound interest.

- Contribute Regularly: Consistent contributions can help you build wealth over time and take advantage of market fluctuations.

- Rebalance Your Portfolio: Periodically review and adjust your investments to ensure they align with your financial goals and risk tolerance.

Maximizing your Roth Net potential is like nurturing a garden. With the right care and attention, it can flourish and provide abundant rewards. By following these tips, you can ensure that your Roth Net is growing strong and healthy.

Overcoming Challenges in Roth Net

No financial strategy is without its challenges, and Roth Net is no exception. Here are some common challenges and how to overcome them:

- Income Limits: If you exceed the income limits for contributing to a Roth IRA, consider using a backdoor Roth IRA to get around this restriction.

- Market Volatility: While market fluctuations can be nerve-wracking, sticking to your long-term strategy can help you weather the storms.

- Tax Changes: Stay informed about potential tax law changes that could impact your Roth Net strategy and adjust accordingly.

Overcoming challenges in Roth Net is like climbing a mountain. It may be tough at times, but the view from the top is worth it. By staying focused and adaptable, you can navigate any obstacles that come your way.

Seeking Professional Guidance for Roth Net

If you're feeling overwhelmed or unsure about how to implement your Roth Net strategy, don't hesitate to seek professional guidance. A financial advisor can help you navigate the complexities of Roth Net and create a personalized plan that meets your unique needs and goals.

Think of a financial advisor as your personal coach. They can provide the expertise and support you need to make informed decisions about your financial future. By working with a professional, you can ensure that your Roth Net strategy is on track and aligned with your long-term goals.

Conclusion: Embrace the Power of Roth Net

In conclusion, Roth Net offers a powerful and flexible tool for building a secure financial future. By understanding its benefits, navigating its rules, and implementing a solid strategy, you can harness the full potential of Roth Net to achieve your financial goals.

So, what are you waiting for? Take the first step today by setting up a Roth IRA or consulting with a financial advisor to explore your options. Remember, the earlier you start, the more time your money has to grow. And who knows? With Roth Net on your side, you might just find yourself retiring earlier and living the life you've always dreamed of.

Don't forget to share this article with your friends and family. Knowledge is power, and the more people who understand the benefits of Roth Net, the better. Together, we can create a financially empowered community. So, go ahead and spread the word. Your financial future depends

- Kenny Smith Allstar The Journey Achievements And Legacy

- Is Shaq Married The Untold Story Behind The Big Diesels Love Life

Where to invest first Roth IRA or a taxable brokerage account

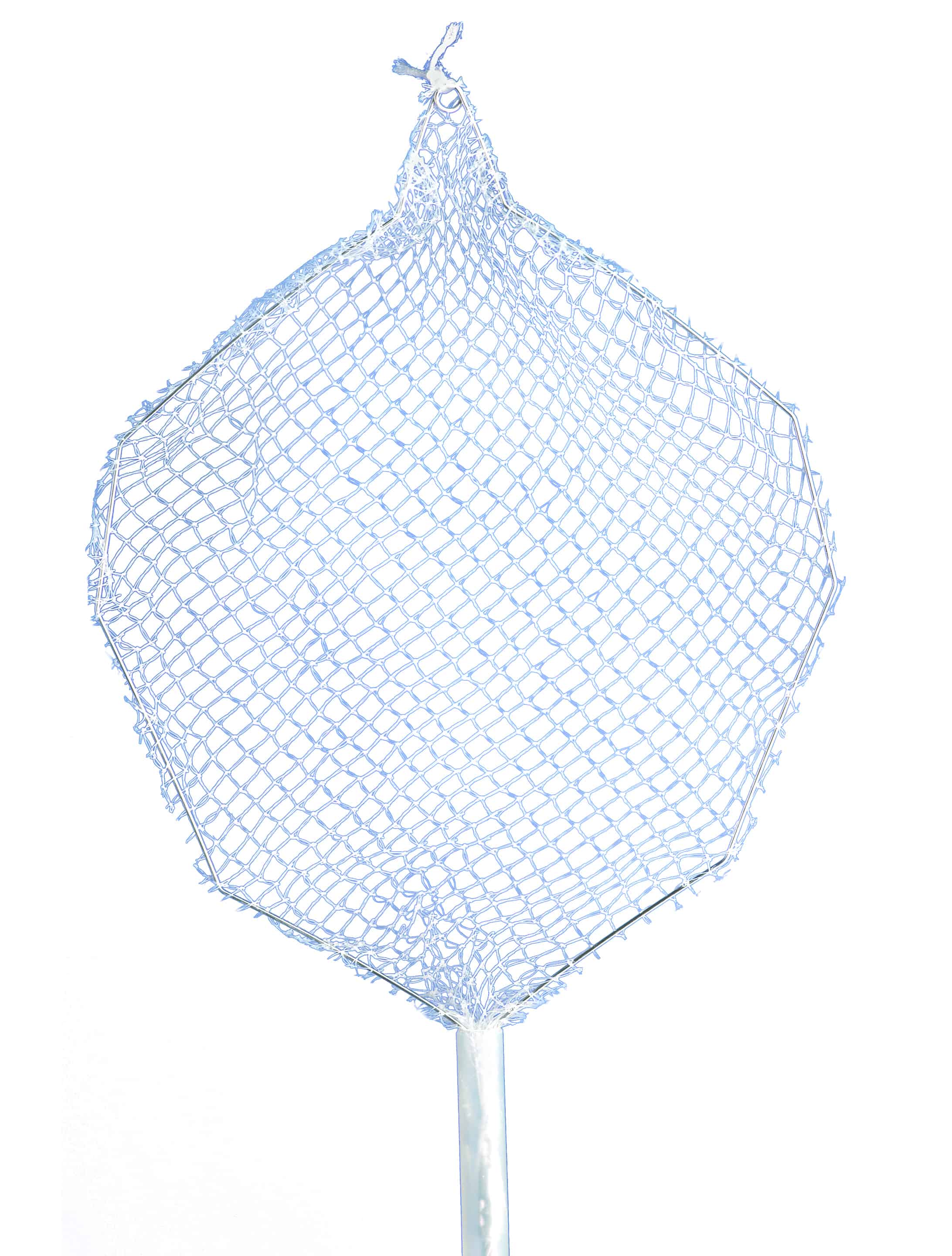

Roth Net Retrieval Devices • Diagmed Healthcare

Amanda Roth