Chase 1098: Your Ultimate Guide To Unlocking Tax Benefits

Hey there, tax-savvy friend! Are you ready to dive deep into the world of Chase 1098? If you're reading this, chances are you've stumbled upon this mysterious term while navigating the labyrinth of tax deductions and mortgage interest reports. Don't worry; we've got your back. Chase 1098 isn't just some random jargon—it's your golden ticket to unlocking potential tax savings. Let's break it down, shall we?

Now, I know what you're thinking: "Why should I care about Chase 1098?" Well, my friend, understanding this form can mean the difference between paying more taxes than necessary and keeping more of your hard-earned cash. Whether you're a first-time homeowner or a seasoned property owner, the Chase 1098 form plays a crucial role in your annual tax filings.

Before we get into the nitty-gritty, let's set the stage. This isn't just another boring tax guide. We're going to make this journey as engaging and straightforward as possible. Think of it as a treasure hunt for tax deductions, where Chase 1098 is your trusty map. So, grab your favorite beverage, get comfy, and let's unravel the mystery together.

- Michael Cimino Actor The Man Behind The Lens And Beyond The Spotlight

- Luke Nichols Wikipedia A Deep Dive Into The Life And Legacy Of A True Star

What Exactly Is Chase 1098?

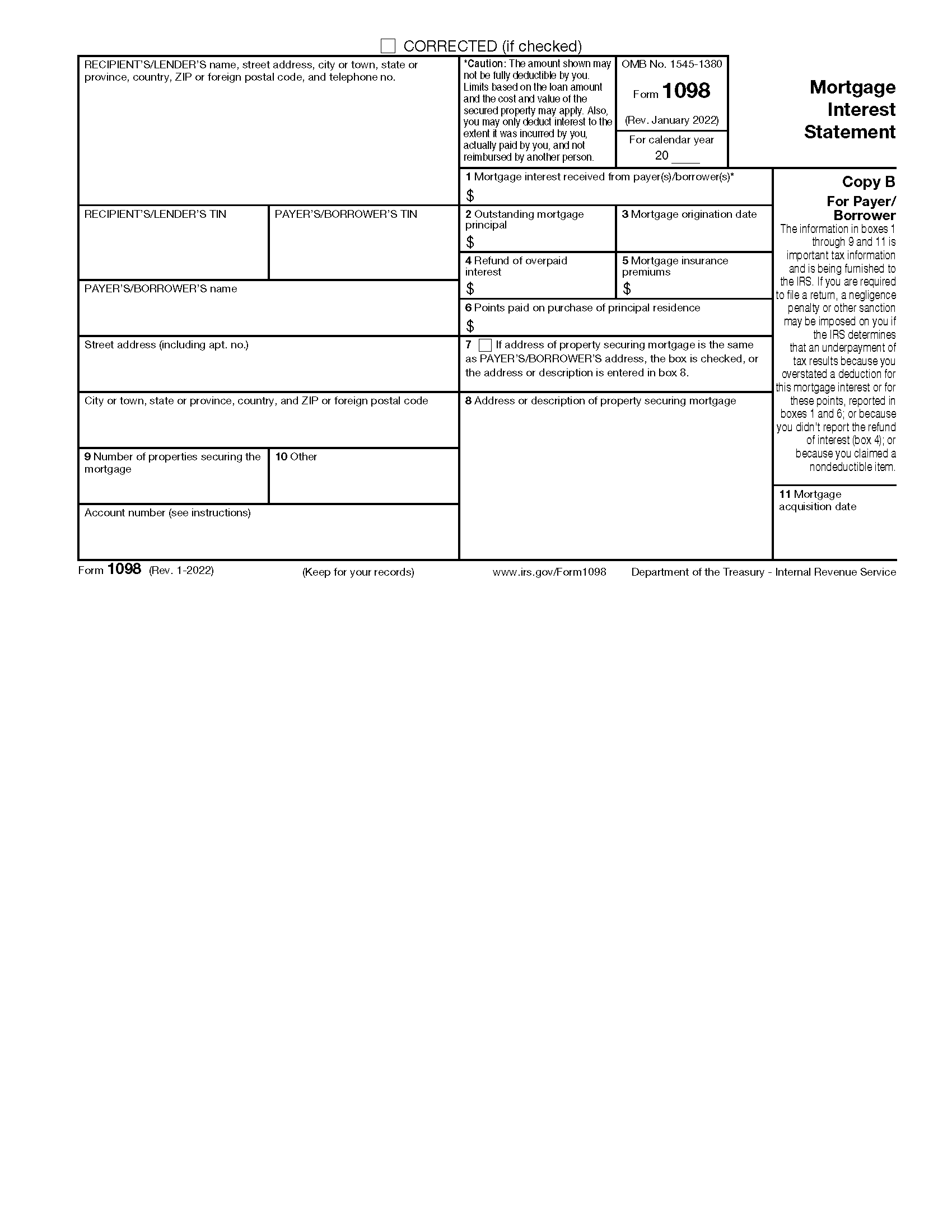

Alright, let's start with the basics. Chase 1098 is essentially a form provided by Chase Bank to borrowers who have paid mortgage interest during the tax year. It's like a receipt that says, "Hey, you paid X amount in mortgage interest, and guess what? That could be tax-deductible!" It's not just about the numbers; it's about taking advantage of every deduction available to you.

This form is a variation of the IRS Form 1098, which is used to report mortgage interest payments. Chase, being one of the largest mortgage lenders, issues its own version to make things easier for its customers. Think of it as Chase's way of saying, "We've got your back when it comes to taxes."

Why Does Chase 1098 Matter?

Here's the deal: Chase 1098 isn't just a piece of paper (or a digital file, depending on how you receive it). It's a powerful tool that can significantly impact your tax return. If you're itemizing deductions on your tax return, the mortgage interest reported on the Chase 1098 form can help reduce your taxable income. And who doesn't want to pay less in taxes?

- Goggins Actor The Rise Of A Fitness Icon In Hollywood

- Alanna Masterson Relationship The Inside Scoop On Love Life And Everything In Between

Let me break it down for you. Imagine you paid $10,000 in mortgage interest last year. Without the Chase 1098 form, you might miss out on claiming that as a deduction. But with it? You could potentially lower your taxable income by that amount, leading to a bigger refund or lower tax bill. It's like finding money in an old jacket pocket—unexpected and awesome.

Who Needs to Care About Chase 1098?

Not everyone needs to worry about Chase 1098, but if you fall into any of these categories, it's definitely something you should pay attention to:

- Homeowners with a mortgage from Chase Bank.

- Those who paid more than $600 in mortgage interest during the tax year.

- Anyone looking to maximize their tax deductions.

Basically, if you're a Chase mortgage borrower, this form is your new best friend. Even if you're not sure whether you qualify for the deduction, it's worth checking out. You never know what you might find!

How Does Chase 1098 Work?

Now that we know what Chase 1098 is and why it matters, let's talk about how it works. The process is pretty straightforward, but there are a few key steps you need to follow to make the most of it.

First, Chase will send you the 1098 form by January 31st of the following year. You'll receive it either by mail or through your online account, depending on your preferences. Once you have the form, it's time to gather all your other tax documents and start preparing your return.

Step-by-Step Guide to Using Chase 1098

Here's a quick breakdown of what you need to do:

- Review the Chase 1098 form to ensure all the information is correct.

- Gather any additional mortgage-related documents you might need.

- Input the mortgage interest amount from the Chase 1098 form into your tax software or on Form 1040 Schedule A if you're filing manually.

- Double-check your calculations to avoid any errors.

It's as simple as that! With these steps, you'll be well on your way to claiming those valuable deductions.

Common Questions About Chase 1098

Let's address some of the most common questions people have about Chase 1098. These FAQs will help clarify any confusion and ensure you're fully prepared come tax season.

Do I Need to File Chase 1098 With My Taxes?

No, you don't need to send the Chase 1098 form to the IRS. It's simply a record of your mortgage interest payments. However, you should keep it on file in case the IRS requests proof of your deductions.

What Happens If I Don't Receive My Chase 1098?

If you haven't received your Chase 1098 form by late January, don't panic. You can contact Chase directly to request a copy. Alternatively, you can estimate your mortgage interest based on your monthly statements, but it's always best to have the official form for accuracy.

Maximizing Your Tax Deductions

Now that you understand the basics of Chase 1098, let's talk about how to maximize your tax deductions. There are a few strategies you can employ to ensure you're not leaving any money on the table.

Tips for Maximizing Your Deductions

- Keep meticulous records of all your mortgage-related expenses throughout the year.

- Consider bundling deductions in high-interest years to take advantage of larger deductions.

- Consult with a tax professional to explore other potential deductions you might qualify for.

By following these tips, you can ensure you're getting the most out of your Chase 1098 form and other tax deductions.

Chase 1098 and the IRS: What You Need to Know

Understanding how Chase 1098 interacts with the IRS is crucial for a smooth tax filing process. The IRS uses the information reported on the 1098 form to verify the accuracy of your tax return. This means it's essential to report the correct amount of mortgage interest and ensure all your documents align.

If there's a discrepancy between your reported mortgage interest and the amount Chase sends to the IRS, you might receive a notice. That's why it's so important to double-check everything before filing.

Real-Life Examples of Chase 1098 in Action

To give you a better idea of how Chase 1098 works in practice, let's look at a couple of real-life examples.

Example 1: First-Time Homeowner

Meet Sarah, a first-time homeowner who just bought her dream house. She has a mortgage with Chase and received her Chase 1098 form in January. By claiming the mortgage interest deduction, Sarah was able to reduce her taxable income by $8,000, resulting in a much larger tax refund than she expected.

Example 2: Long-Term Property Owner

Then there's John, who has owned his home for over a decade. He's been paying down his mortgage steadily and receives his Chase 1098 form every year. Even though his annual mortgage interest payments have decreased over time, he still benefits from the deduction, saving hundreds of dollars each year.

Troubleshooting Common Issues

Let's face it—tax season can be stressful. If you encounter any issues with your Chase 1098 form, here's what you can do:

- Double-check all the information on the form for accuracy.

- Contact Chase customer service if you notice any discrepancies.

- Consult a tax professional if you're unsure about how to proceed.

Remember, it's always better to address potential issues early rather than waiting until the last minute.

Final Thoughts on Chase 1098

Well, there you have it—your comprehensive guide to Chase 1098. By now, you should have a solid understanding of what it is, why it matters, and how to use it to your advantage. Whether you're a first-time homeowner or a seasoned property owner, Chase 1098 can be a game-changer for your tax strategy.

So, what's next? Take a moment to review your Chase 1098 form (if you haven't already) and make sure you're taking full advantage of all the deductions available to you. And don't forget to share this article with your friends and family who might benefit from the information. Together, we can all become smarter, savvier taxpayers.

Got questions? Leave a comment below, and I'll do my best to help you out. Happy tax saving, folks!

Table of Contents

- What Exactly Is Chase 1098?

- Why Does Chase 1098 Matter?

- Who Needs to Care About Chase 1098?

- How Does Chase 1098 Work?

- Common Questions About Chase 1098

- Maximizing Your Tax Deductions

- Chase 1098 and the IRS: What You Need to Know

- Real-Life Examples of Chase 1098 in Action

- Troubleshooting Common Issues

- Final Thoughts on Chase 1098

- Dwayne Johnson Biography Movie The Rocks Journey From Wrestling To Hollywood Stardom

- Did Dwayne Johnson Die Debunking The Rumors And Celebrating The Rock

1098010 Fabric

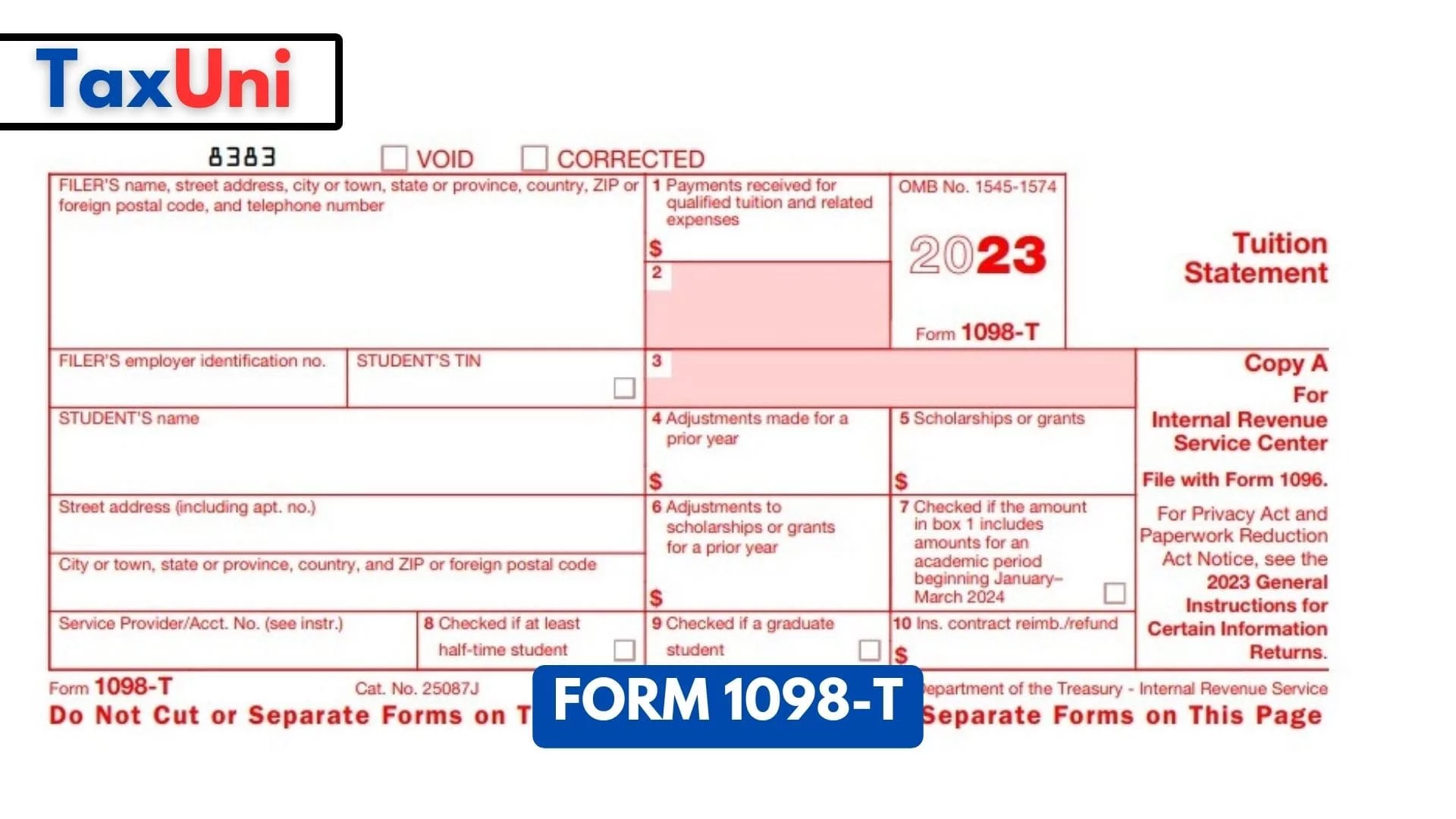

Form 1098T 2024 2025

Free IRS Form 1098 PDF eForms