2025 Colorado Employee Withholding Certificate: A Comprehensive Guide For Employees And Employers

Let’s talk about something that affects every working individual in Colorado—the 2025 Colorado Employee Withholding Certificate. If you’re an employee or employer in the Centennial State, this document is your go-to tool for managing state income tax withholding. It might sound like a boring topic, but trust me, understanding it can save you big bucks come tax season. Whether you’re a fresh graduate starting your first job or a seasoned professional, knowing how this certificate works is crucial for financial planning.

This isn’t just some random form; it’s a key part of your payroll process. The certificate helps determine how much state income tax your employer should withhold from your paycheck. Get it wrong, and you could end up owing money to the IRS—or worse, getting a huge refund that could’ve been in your pocket all year. So, let’s break it down step by step and make sense of it all.

By the end of this guide, you’ll not only understand what the 2025 Colorado Employee Withholding Certificate is but also how to fill it out correctly. We’ll cover everything from its purpose to common mistakes people make when completing it. Let’s dive in!

- Is Shaq Married The Untold Story Behind The Big Diesels Love Life

- Whats The Real Deal Behind The Upside Down Flag Meaning Lets Dive In

What Is the 2025 Colorado Employee Withholding Certificate?

The 2025 Colorado Employee Withholding Certificate, also known as the DR 1098-NW, is a form used by employees in Colorado to inform their employers about their personal tax situation. This information is then used by employers to calculate how much state income tax to withhold from each paycheck. Think of it as a blueprint for your taxes.

In simple terms, the certificate allows you to claim allowances based on your filing status, dependents, and other factors. These allowances directly affect the amount of tax withheld from your salary. For example, if you claim more allowances, less tax will be withheld. Conversely, fewer allowances mean more tax is withheld.

Here’s the kicker: getting this form right is essential because it determines whether you’ll owe money or get a refund at the end of the year. Too little withholding can lead to penalties, while too much withholding means you’re giving Uncle Sam an interest-free loan. So, it’s all about finding the sweet spot!

- What Is Data Visualization In Iot Unlocking The Power Of Connected Insights

- Luke Nichols Wikipedia A Deep Dive Into The Life And Legacy Of A True Star

Why Is This Form Important?

Let’s cut to the chase—this form is more important than you think. It’s not just another piece of paper to sign when you start a new job. The 2025 Colorado Employee Withholding Certificate plays a critical role in ensuring that the right amount of state income tax is withheld from your paycheck. Here’s why:

- It helps you avoid under-withholding penalties if too little tax is taken out.

- It prevents over-withholding, which means you won’t be giving the government free money all year long.

- It ensures accurate tax calculations, especially if your financial situation changes during the year.

- It simplifies tax season by minimizing surprises when you file your annual return.

Imagine this scenario: you’ve just bought a house, had a baby, or started a side hustle. All these life events impact your taxes, and the withholding certificate is where you communicate those changes to your employer. Without it, you’re flying blind into tax season.

Who Needs to Complete the 2025 Colorado Employee Withholding Certificate?

Basically, anyone who earns a paycheck in Colorado needs to fill out this form. Whether you’re a full-time employee, part-time worker, or even a temp, the DR 1098-NW applies to you. Here’s a quick breakdown:

Employees

If you’re an employee, this form is mandatory when you start a new job. Your employer will usually provide it as part of the onboarding process. However, you can also request a copy from the Colorado Department of Revenue if needed. Remember, this isn’t a one-time deal. You should update your withholding certificate whenever there’s a significant change in your financial situation.

Employers

Employers are required to use the information provided on the DR 1098-NW to calculate state income tax withholding for their employees. They must also keep these forms on file for at least four years. It’s their responsibility to ensure that the correct amount of tax is withheld based on the information employees provide.

How to Fill Out the 2025 Colorado Employee Withholding Certificate

Filling out the DR 1098-NW might seem intimidating at first, but it’s actually pretty straightforward once you know what to do. Here’s a step-by-step guide:

Step 1: Personal Information

Start by entering your personal details, including your name, address, Social Security Number (SSN), and employer’s name. Make sure all this information is accurate because any errors could lead to processing delays.

Step 2: Filing Status

Next, select your filing status. Options include single, married filing jointly, married filing separately, and head of household. Your filing status affects the number of allowances you can claim.

Step 3: Allowances

This is where things get interesting. The number of allowances you claim depends on your personal and financial situation. For example:

- Claim one allowance for yourself.

- Claim additional allowances for dependents or if you’re eligible for certain tax credits.

Remember, each allowance reduces the amount of tax withheld from your paycheck. So, it’s important to claim only what you’re entitled to.

Step 4: Additional Withholding

If you want to withhold extra tax from your paycheck, you can specify an additional amount on this line. This is useful if you expect to owe more tax due to investments, freelance work, or other sources of income.

Step 5: Signature

Finally, sign and date the form. Your signature certifies that the information provided is true and accurate. Without it, the form is invalid.

Common Mistakes to Avoid

Even the most meticulous person can make mistakes when filling out forms. Here are some common errors to watch out for:

- Claiming too many allowances, leading to under-withholding.

- Forgetting to update the form after major life changes, such as marriage or having a child.

- Not signing the form, which renders it incomplete.

- Misplacing the form after submitting it, making it hard to reference later.

Pro tip: Keep a copy of your completed withholding certificate for your records. This way, you can easily refer to it if you need to make changes in the future.

Key Changes for 2025

Every year, there are updates to tax forms and regulations, and 2025 is no exception. Here are some key changes to the Colorado Employee Withholding Certificate:

New Filing Status Options

Starting in 2025, the form includes updated filing status options to better reflect modern family structures. This ensures that more employees can accurately claim the allowances they’re entitled to.

Increased Allowance Values

The value of each allowance has been adjusted to account for inflation. This means that claiming the same number of allowances as last year could result in slightly less tax being withheld. Be sure to review your withholding to ensure it still aligns with your tax goals.

Tips for Optimizing Your Withholding

Now that you know how to fill out the form, here are some tips to help you optimize your withholding:

- Review your withholding annually to ensure it still reflects your current situation.

- Use the IRS withholding calculator to estimate the right number of allowances for your situation.

- Consult a tax professional if you have a complex financial situation, such as multiple jobs or significant investments.

By taking these steps, you can minimize surprises at tax time and keep more of your hard-earned money throughout the year.

Where to Get Help

If you’re still unsure about how to complete the 2025 Colorado Employee Withholding Certificate, don’t worry—you’re not alone. Here are some resources to help:

Colorado Department of Revenue

The Colorado Department of Revenue offers a wealth of information on their website, including downloadable forms, FAQs, and contact details for their customer service team. They’re a great resource for any questions you might have.

Tax Professionals

Sometimes, the best course of action is to consult a tax professional. They can provide personalized advice based on your unique financial situation and help ensure that your withholding is optimized.

Conclusion

So, there you have it—a comprehensive guide to the 2025 Colorado Employee Withholding Certificate. By now, you should have a clear understanding of what it is, why it’s important, and how to fill it out correctly. Remember, this form is your key to accurate tax withholding and financial peace of mind.

Before you go, I’d love to hear your thoughts. Do you have any questions about the withholding certificate? Or maybe you have a tip for optimizing your withholding? Leave a comment below and let’s keep the conversation going. And don’t forget to share this article with your friends and colleagues—knowledge is power, after all!

Table of Contents

- What Is the 2025 Colorado Employee Withholding Certificate?

- Why Is This Form Important?

- Who Needs to Complete the 2025 Colorado Employee Withholding Certificate?

- How to Fill Out the 2025 Colorado Employee Withholding Certificate

- Common Mistakes to Avoid

- Key Changes for 2025

- Tips for Optimizing Your Withholding

- Where to Get Help

- Conclusion

- Virginia Madsen Net Worth A Deep Dive Into The Wealth Of This Talented Actress

- What Is Szas Real Name Discover The Story Behind The Rampb Sensation

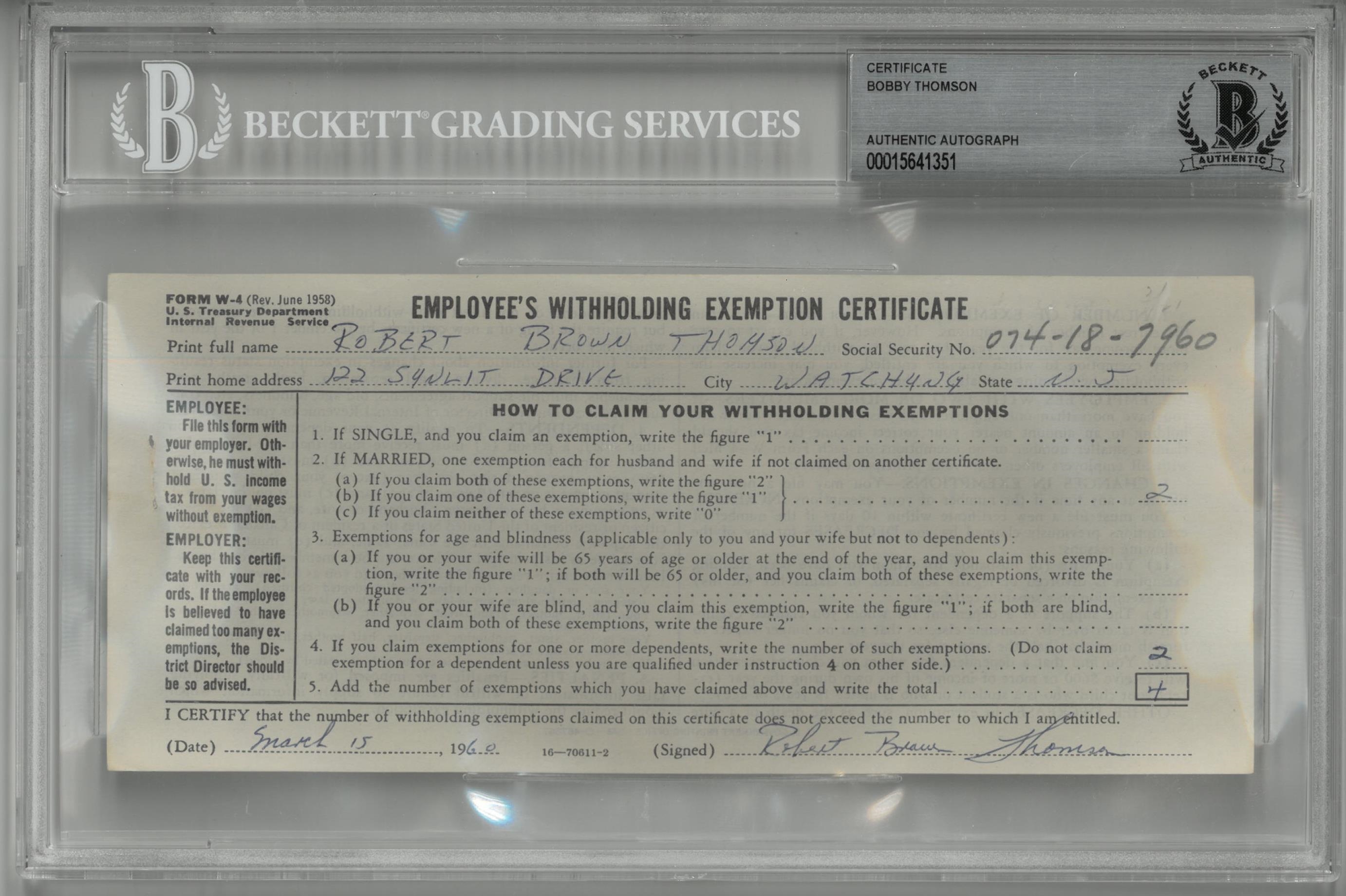

Lot Detail Bobby Thomson's Employee Withholding Certificate

2024 W4 Employee Withholding Certificate Pansy Beatrice

US tax Form W4 Employee Withholding Certificate 14409513 Stock Video